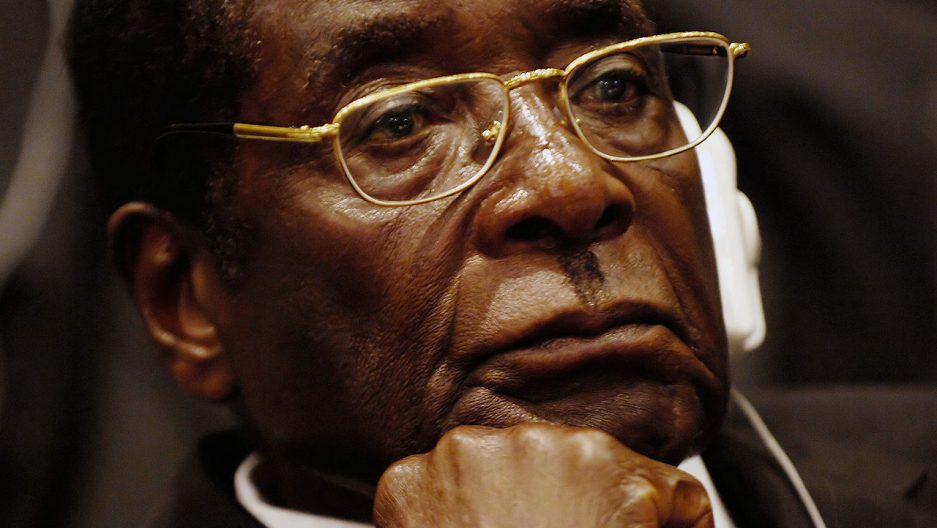

He was Africa’s archetypal icon of post-colonial totalitarianism. Charismatic. Educated. Feared. Endowed with racist tribal arrogance. Unforgiving. 37 years of iron-fisted rule, Mugabe plundered all known indices of democratic decency. He ruthlessly suppressed opposition – incarcerating its leaders, mass-murdering their supporters. He habitually insulted Western leaders, decimated private property rights. Under his rule, cronies blossomed as inflation broke all post World War 2 records. By the time he was deposed in a ‘decent’ military coup, Zimbabwe was in a tailspin of obscene poverty. Despised by the international community, loathed by liberals and social democrats alike.

Yet Africa has a rich tradition not to speak ill of the departed. Their transgressions pale in significance as we ask ourselves if or not we had been fair in our criticisms. Nobody is perfect but some people are evil. We all saw Mugabe through diverse psychosocial prisms. Those 300,000 who received the proceeds of expropriated commercial farms will argue differently. So are the cronies with the lion’s share in public tenders. Every village tyrant has moments of benevolence. Mugabe had one I remember most.

Backson Sibanda, Ignatius Banda, Kenneth Odero, and Innocent Chirisa postulate how Mugabe’s ‘growth point’ concept was an innovation that, if pursued to its logical conclusion, Zimbabwe would be a Singapore by now. Sibanda, an 80’s ‘public servant’ I met in Kenya and lived with for almost a decade into independence wrote about ‘growth points’. He understood Mugabe’s mission of stemming rural-to-urban migration. I could see his common sense, but equally skeptical of Mugabe’s intentions. 70% of Zimbabweans live in rural areas. If you want to consolidate political power, pampering villagers with ‘gifts’ guarantee you a parliamentary majority.

[perfectpullquote align=”right” bordertop=”false” cite=”” link=”” color=”” class=”” size=””]I am not skeptical of foreign direct investment. After all, provinces, especially those with agro-mining strengths, require solid investments. IFMHs must moderate sustainable intra-province skills exchanges rather than trust exploitative Chinese personnel.[/perfectpullquote]

Nonetheless, forty years down the line, the four’s incisive review of the ‘growth point’ concept grabs my attention. For simple reasons. I opined on rapid post-COVID-19 development leveraged by Innovation Free Market Hubs IFMHs. It then makes sense that if each of Zimbabwe’s ‘rural’ provinces has ‘growth points’, they can be centres of Zimbabwe’s comparative ‘industrialisation’. However, I do not see many rural Sandton Cities on the continent for a long time to come.

Says an IPS treatise “According to analysts, growth points were meant to develop into towns, complete with their own industries and housing estates. Their purpose was to provide employment in rural areas and improve the local economy, without forcing people to migrate to large cities and towns to find work.” Conflate this with my IFMHs model; it makes sense that ‘growth points’ become nodes to drive development based on that region’s comparative advantage.

For instance, the time-worn argument is how Mugabe ‘neglected’ Matabeleland North for political reasons, but IFMHs can reverse this self-defeating mentality by identifying the province’s natural strengths. ‘Growth points’ say in Lupane, Jotsholo, Nkayi, Ntabazinduna, and Binga are the fulcrum of IMFHs-leveraged leather, timber, gas, coal, and tourism ‘industrialisation’. The Zambezi River, Victoria Falls, Hwange Game Reserve, Lupane timber, and Lupane gas are excellent endowments on their own.

Whichever way, property rights assume the cog of a sustainable investment drive. Infrastructure leverages exploitation of natural resources, yet if the government blunders through titled ownership, even the urban-based Zimbabwe Development Agency model will be extinct. Communal ownership inspired by populism has no place in my IFMHs ‘growth point’ developmental algorithm. Odero and Chirisa unravel the immense abundance of natural resources, yet the country’s obsession with commodity exports underwritten by multinational corporations adds zilch to provincial development.

I am not skeptical of foreign direct investment. After all, provinces, especially those with agro-mining strengths, require solid investments. IFMHs must moderate sustainable intra-province skills exchanges rather than trust exploitative Chinese personnel. Hwange has mining expertise transferrable to Lupane methane gas. Victoria Falls, Hwange Game Reserve and Zambezi valley lodges can ‘trade’ tourism skills while Lupane University remodels its courses to suit local IFMHs milestones.

The exponential rise of cellular and renewable energy technologies ushers a new era of self-contained infrastructure. It, therefore, is common sense how Zimbabwe’s post-COVID-19 resurgence is dependant not just on sound policy but harnessing the potential of Mugabe’s ‘growth points’ using the IFMHs model.

Rejoice Ngwenya is the founder of the advocacy group, COMALISO based in Ruwa, Zimbabwe.