The so-called Africa risk premium is built on perception, not data – and it’s crushing the continent’s commercial potential.

A friend who runs a business in Nigeria told me she was recently asked to put up her home as collateral for an expansion loan. Yet the bank still demanded 30% of the amount in cash despite the fact that the value of her home far exceeded the amount she was borrowing.

To manage cash flow, she relies on a costly overdraft with a 33% (!) interest rate and has given up attempts to scale her business.

Welcome to the reality of entrepreneurship in Africa.

True price of global media perceptions

When we released ‘The Cost of Media Stereotypes’, a report by Africa No Filter and Africa Practice, we set out to quantify how media stereotypes were inflating the cost of borrowing for African governments.

What we found was staggering: Africa pays up to $4.2bn more each year in avoidable interest payments because of the way it is perceived in global media.

The report showed that during election periods, 88% of international media articles about Kenya and 69% about Nigeria carried a negative tone, compared to just 48% for Malaysia, a country with similar political risk. This kind of distortion doesn’t just affect reputation; it affects the price of capital.

But what the report didn’t cover – and what urgently needs attention – is the cost of those perceptions to Africa’s entrepreneurs; the very people tasked with driving growth, creating jobs, and fuelling our continent’s development.

Uneven playing field

The so-called ‘Africa risk premium’, which our report tried to unpack, isn’t just impacting sovereign debt and contributing to the debt crisis many countries find themselves in; it is also impacting business. Start-ups, SMMEs, and micro-enterprises are being crushed under the weight of an unfair financial system. And that system is built on the story of risk.

The story of Africa’s perceived risk is driven largely by outdated, negative, and often biased global narratives of conflict, corruption, and instability.

These stories make it more expensive for our countries, as well as our local banks, to raise capital from international markets. That higher cost trickles down, as local banks pass this same costly money directly on to borrowers.

Changing the narrative means investing in local and global storytelling.

The result? Interest rates for small businesses in Africa routinely range from 15% to 30%, while their counterparts in Europe or the US (where the Federal Reserve recently announced interest rates around 4%) can access credit at much lower rates, typically between 4% and 8%.

This stark difference in pricing illustrates how global perceptions directly translate into an unfair cost of capital for African entrepreneurs.

Imagine trying to manufacture solar panels in South Africa, build a media business in Kenya, or grow a hotel chain across Francophone Africa. Now imagine trying to compete with Chinese, European, and US brands, who have access to cheaper capital and probably trade incentives from their government.

It’s the reason why only 11 of the top 100 most admired brands in Africa are from Africa, according to the 2025 Brand Africa 100 rankings.

Call for greater transparency

The impact of this story goes beyond individual businesses to entire sectors. For example, the green hydrogen sector, which many consider to be Africa’s next big play, may not take off at all. Despite investor appetite, projects in places like Namibia and South Africa are now being re-evaluated because the financing costs are simply too high.

It’s a perfect illustration of how Africa is rich in opportunity but poor in affordability. So how can we build globally competitive industries and businesses when we start from such a deep financing disadvantage?

One step in the right direction is to call for greater transparency in how risk is assessed and priced. Global credit agencies and institutional investors, despite their best efforts at objectivity, still rely on subjective indicators, and those perceptions are often shaped by headlines, not data.

While the Africa Credit Risk Agency has faced some criticism and may not be the answer, it marks a crucial first step toward building homegrown institutions and establishing long-term, African-led solutions for risk assessment across the continent.

But of all the solutions being explored, the one least likely to attract investment, but with the potential for the most transformative impact, is changing the narrative about the continent. I know this because I see very little investment in media and storytelling – the platforms on which narrative is built.

Changing the narrative means investing in local and global storytelling – in both the creators and the platforms because we need strong, credible media brands that can showcase African progress, success, and innovation globally.

Changing the narrative is an economic imperative because for African businesses like my friends’ company to grow, generate employment, and transition from survival mode to a large enterprise, affordable capital is essential.

We need to get our story right.

Moky Makura is the executive director of www.AfricaNoFilter.org.

Article first appeared in The Africa Report.

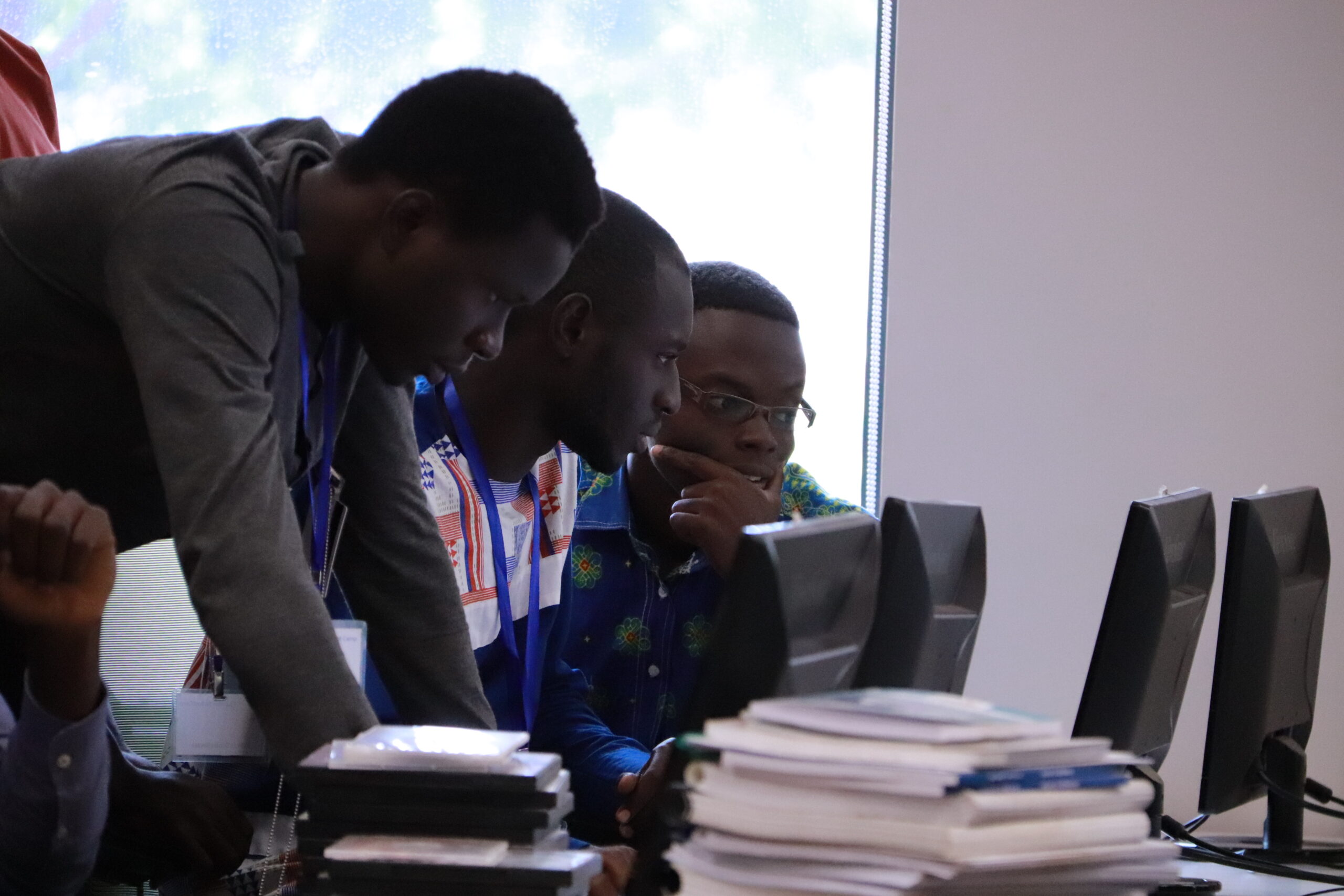

Photo by U.S.EmbassyBF via Unsplash.