The implementation of the African Continental Free Trade Area (AfCFTA) has the potential to revolutionize the continent’s economy and spur innovation. The primary goals of the AfCFTA, which has been signed by 54 African states, is to increase the amount of intra-African trade, grow the continent’s economic output, and improve the continent’s trading position in the global market. Fortunately, other positive innovations that could help Africa’s economy are emerging too.

Although the AfCFTA may be a recent development, free trade is not new in Africa. Africans have a long history of exchanging goods across all regions of the continent. However, intra-African trade currently accounts for only 16 percent of the continent’s total trade, compared to almost 70 percent in Europe. Such little regional integration has occurred primarily due to artificial economic barriers constructed during the colonial era and the pursuit by African leaders of protectionism after independence. These barriers to trade continue to haunt the continent today and many challenges, such as high tariffs, border delays, and high transaction costs for cross-border payments, remain. Clearly, every policy that infringes upon the African peoples’ economic freedom must be addressed, and thankfully some are being looked into.

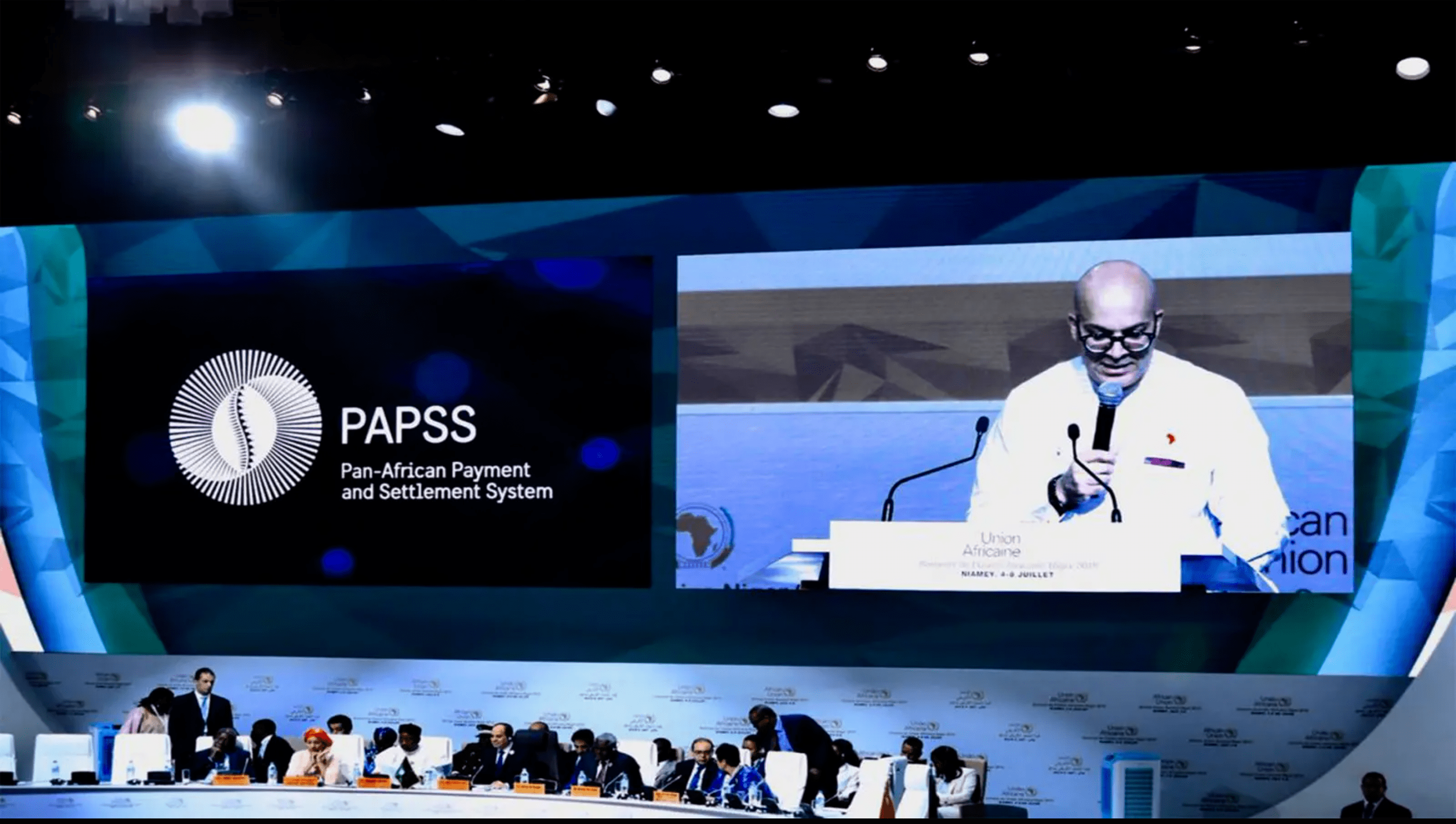

In the area of cross-border payments, progress is being made. In January, the African Export-Import Bank (AfreximBank) introduced the novel Pan-African Payment and Settlement System (PAPSS), which is a centralized cross-border financial system created to enable payment transactions across the continent. By reducing costs, making transactions quicker, and decreasing liquidity requirements of commercial and central banks, PAPSS has enormous potential to boost the efficiency of cross-border trade across Africa.

How Has Africa Been Making Cross-Border Payments Before Now?

Before introducing PAPSS, cross-border payments in Africa were mainly coordinated on the SWIFT (Society for Worldwide Interbank Financial Telecommunication) network. SWIFT is a system overseen by the central banks of G-10 countries that allows banks across the globe to send messages and complete transactions.

[perfectpullquote align=”left” bordertop=”false” cite=”” link=”” color=”” class=”” size=””]Godwin Emefiele, the Central Bank of Nigeria’s governor, said PAPSS would simplify cross-border transactions, reduce the dependency on third-party currencies, and amplify intra-African trade significantly from 15 percent to 35 percent over the period of five years.[/perfectpullquote]

According to the African Development Bank, 48 percent of settlement processes – which is the transfer of funds through a central system from a payer to a receiver – within Africa, involve banks outside the continent. This makes transaction costs high and negatively impacts the productivity of African businesses. For example, if an entrepreneur in Ethiopia wants to order a good from a supplier in Ghana, that entrepreneur would have to acquire U.S. dollars and use a system that would direct the payment to the United States, before routing it back to the client bank in Ghana. According to Ben Oramah, president of the Afreximbank, using the SWIFT system in Africa costs the continent nearly $5 billion annually, while taking 2 to 14 days to process transactions.

Over 80 percent of the transactions sent from Africa are processed in the United States but have their recipients in other regions. The Asia-Pacific and Europe (non-Eurozone) regions account for a combined 52 percent of where the payments are eventually transferred, compared to only 17 percent for Africa. This shows the intermediation role of U.S. dollar clearing banks. And, according to Godwin Emefiele of the Central Bank of Nigeria, the reliance on these third-party currencies, like the U.S. dollar, pounds, and euro, destabilizes Africa’s foreign exchange market and causes problems for the manufacturing sector.

Without an efficient and functioning payment system, Africa cannot effectively facilitate international or regional trade. This makes PAPSS an important tool to resolve payment bottlenecks.

PAPSS: How Does It Work?

PAPSS enables instant payments across African borders in local currency. Its three core processes are instant payment, pre-funding, and net settlement. With this new system, businesses will no longer need to convert local currencies to foreign currencies before they can make purchases across the continent, significantly reducing the amount of time it will take to complete a transaction. PAPSS will make and process payments within two minutes.

The system also allows users to pre-fund their accounts before transactions are initiated. This pre-funding arrangement is available to direct participants (mainly banks) who are required to have a real-time gross settlement (RTGS) account with their central banks. To initiate transactions, indirect participants without an RTGS account would need a direct participant to help fund or defund their clearing accounts on PAPSS.

In addition, the PAPSS system processes settlements within 24 hours across all participating central banks at the same time. In simple terms, throughout the day a bank accumulates credits and debits, meaning that it will simultaneously owe and be owed money. The PAPSS system makes sure that at the end of the day, the payments are settled, and banks have enough cash to operate.

What Does This Mean For Africa?

Since piloting the system through six central banks from the WAMZ (West African Monetary Zone) in August 2021, the payment system has been sending live transactions.

Godwin Emefiele, the Central Bank of Nigeria’s governor, said PAPSS would simplify cross-border transactions, reduce the dependency on third-party currencies, and amplify intra-African trade significantly from 15 percent to 35 percent over the period of five [AH1] years. He added that it would strengthen the foundation for the potential monetary union within the region and enable businesses to expand and create value.

The implementation of PAPSS will help Africa become a market open to the movement of goods and people, through improved financial transactions. As the continent forges ahead on the AfCFTA, a critical economic integration project, resolving payment and settlement bottlenecks will help African currencies retain value. Finally, PAPSS will also serve as a verifiable platform for supporting business-to-business eCommerce within Africa. In short, PAPSS could drastically improve the efficiency of cross-border trade across Africa and in doing so, it will likely make millions of Africans richer in the process.

First appeared in Premium Times.

Lanre-Peter Elufisan is the Executive Director of the Ominira Initiative for Economic Advancement.